Credit Card Insurance vs Travel Insurance – Understand the Differences and Choose the Right Coverage for Your Travel Needs

When planning a trip, one important decision travelers often overlook is choosing the right protection for unexpected events. Credit card insurance vs travel insurance—which one should you rely on? While both offer benefits, understanding the differences can help you make the best choice and travel with peace of mind.

What is Credit Card Insurance?

Credit card insurance is a benefit offered by many credit card companies when you use their card to book your travel. Depending on the card issuer, you may receive coverage for trip cancellation, rental car damage, baggage delay, and emergency medical situations. However, coverage varies significantly and often comes with limitations.

Pros:

Included with your credit card (no extra cost)

Easy to use if booking travel with the card

May offer rental car coverage or baggage delay protection

Cons:

Limited coverage amounts

May exclude pre-existing medical conditions

Not all cards offer the same level of protection

What is Travel Insurance?

Travel insurance, on the other hand, is a standalone policy you purchase separately. It typically includes more comprehensive coverage such as trip interruption, emergency evacuation, medical expenses, lost luggage, and even coverage for pre-existing conditions if certain requirements are met.

Pros:

Customizable and often more comprehensive

Higher coverage limits for medical and trip-related issues

Covers a wide range of scenarios, including travel delays and cancellations

Cons:

Comes at an additional cost

Requires research and comparison to choose the right plan

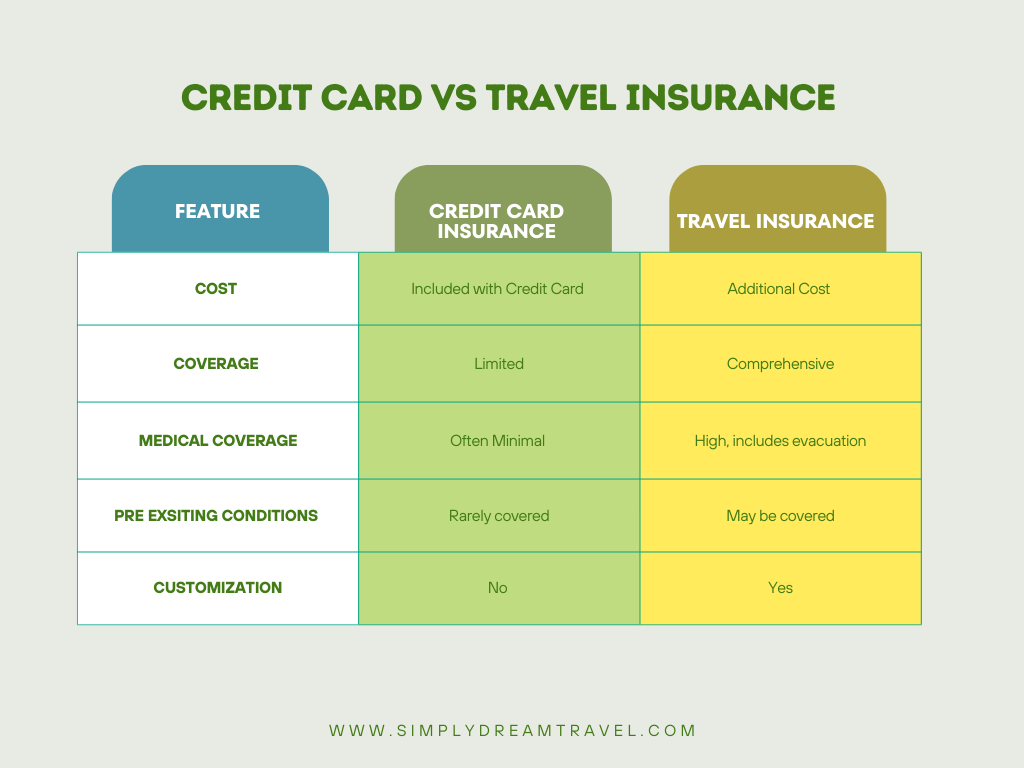

Credit Card Insurance vs Travel Insurance: Key Differences

When comparing credit card insurance vs travel insurance, the key differences lie in the extent of coverage and cost. While credit card insurance can be a convenient and cost-saving option for short trips, it often lacks the depth of protection needed for international or extended travel.

Which One Should You Choose?

If you’re going on a short domestic trip and have a premium credit card with solid travel benefits, your credit card insurance might be sufficient. But for international travel, family vacations, or trips involving high prepaid costs, travel insurance offers far more reliable protection and peace of mind.

For the best protection, consider combining both. Use your credit card to book your trip (to activate built-in benefits), and purchase travel insurance to fill in any coverage gaps—especially for medical emergencies and cancellations..

Credit card insurance vs travel insurance is a decision that comes down to the type of trip you’re taking, your personal health needs, and how much risk you’re willing to accept. Don’t assume your credit card has you fully covered—read the fine print and evaluate your travel plans carefully.

Being informed helps you avoid unexpected costs and ensures you can focus on enjoying your adventure. Safe travels!

If you’d like to learn more about travel insurance and how it compares to credit card coverage, we’re here to help! At Simply Dream Travel, we make sure you’re fully informed and confidently prepared for your next adventure. Whether you’re ready to book your dream vacation or just have questions, contact us today and let us take care of the details, so you can focus on making unforgettable memories.